The 2008 crash continues as a source of debate, probably because after six years the recovery is still not complete. We differ on what caused the crash. There are liberal versions, there are conservative versions, both are wrong.

The liberal explanation

Liberals reflexively point to business as the source of any problem. They’ll tell you the 2008 crash was a case of Wall Street running wild, cheating Americans with trick mortgages and fraudulent mortgage-backed securities. For an authentic liberal narrative, see the conclusions of the Financial Crisis Inquiry Commission:

- We conclude this financial crisis was avoidable.

- We conclude widespread failures in financial regulation and supervision proved devastating to the stability of the nation’s financial markets.

- We conclude dramatic failures of corporate governance and risk management at many systemically important financial institutions were a key cause of this crisis.

- We conclude a combination of excessive borrowing, risky investments, and lack of transparency put the financial system on a collision course with crisis.

- We conclude the government was ill prepared for the crisis, and its inconsistent response added to the uncertainty and panic in the financial markets.

- We conclude there was a systemic breakdown in accountability and ethics.

- We conclude collapsing mortgage-lending standards and the mortgage securitization pipeline lit and spread the flame of contagion and crisis.

- We conclude over-the-counter derivatives contributed significantly to this crisis.

- We conclude the failures of credit rating agencies were essential cogs in the wheel of financial destruction.

The conservative explanation

Similarly, conservatives reflexively point to government as the source of any problem. Government pushed banks, Fannie Mae and Freddie Mac to insure or even buy mortgages for the poor, who basically ripped off the system.

A better explanation…

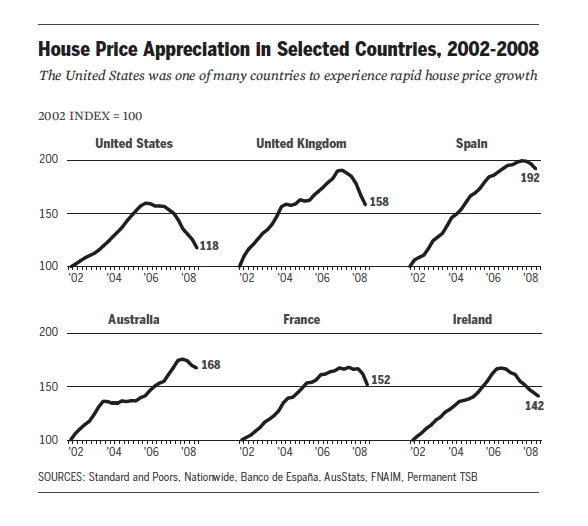

The problem with both the conservative and liberal explanations is that they focus on conditions specific to the US. The 2008 crash was global.

Housing bubbles emerged in numerous countries, like Ireland, with very different regulatory regimes and political cultures than ours. Financial firms collapsed all over the world. There is no way to explain all of this by citing U.S. economic policies

See this exhibit from the dissent to the Financial Crisis Inquiry Commission report:

The 2008 crash was not due to the causes commonly identified by either liberals or conservatives. Many of these causes contributed to the crash, but they didn’t cause it. The financial deregulation and expansionist housing policies of the 1990s were bipartisan. Accountability, ethics, and greed played roles, but are not unique in any political persuasion or economic class.

What is the metric to determine the success of regulation? How do you improve accountability and ethics, and what to do about greed? All of these are great questions, but don’t point to causes of the 2008 crash, or ways to prevent the next crash.

For the best explanation, one that follows the money and takes into account the global roots of the crash, see the dissent to the Financial Crisis Inquiry Commission report:

- A credit bubble. China and the oil-producing states developed large capital surpluses, then loaned these savings to the US and Europe. Interest rates fell.

- A housing bubble, in the US and other countries.

- High-risk nontraditional mortgages amplified the housing bubble in the US.

- Mortgage securitization (CDOs) and erroneous credit ratings transformed bad mortgages into toxic financial assets, and fueled creation of more bad mortgages.

- Financial institutions made big bets on housing (concentrated correlated risk).

- Financial institutions over-leveraged (too little capital relative to the risks they were carrying on their balance sheets).

- The financial system was too vulnerable to contagion through interconnectedness (counter party credit risk).

- The financial system was too vulnerable to a common shock. Unrelated firms made the same investment, then failed at roughly the same time due to that investment failing.

- Global panic, evaporation of confidence and trust.

- The financial panic then caused a contraction in the real economy.

The bottom line

Liberals have their list of causes, focused on deregulation and misbehavior in the financial industry. Deregulation did occur, but liberals share the blame. See Senator Charles Schumer, and the legislative history in Congress. Misbehavior occurred. Presumably the guilty were prosecuted, but that’s another topic.

Conservatives blame government involvement in the housing market. The Community Reinvestment Act, Fannie Mae and Freddie Mac are distasteful to fans of small government, but they did not cause the crash.

The crash occurred across the globe. Root causes cannot be found in US government policy or US financial institutions.

Six years after the fact, after hundreds of doctoral dissertations have likely been written on the subject, there is still no agreement on the true causes of the 2008 crisis. If you cannot define the problem, there can be no effective solution or remedy.